If you’re over 65 or planning ahead for retirement, understanding Medicare can feel like navigating a maze.

Many people ask, “What does Medicare cover?” and the answer isn’t always straightforward.

Medicare isn’t just one plan; it’s a combination of programs designed to cover different healthcare needs, including hospital care, doctor visits, preventive services, and prescription drugs.

Knowing what’s included and what’s not can save you from unexpected bills and help you make smarter decisions about your health coverage.

In this guide, we’ll break down Medicare into its main components: Part A, Part B, Part C (Medicare Advantage), and Part D (prescription drugs).

We’ll explain what each part covers, the costs involved, and tips to maximize your benefits.

By the end, you’ll have a clear roadmap to confidently navigate your Medicare coverage and make the most of your healthcare options.

Overview of Medicare

Medicare is the federal health insurance program primarily for people aged 65 and older, though some younger individuals with certain disabilities or conditions also qualify.

The program is designed to help cover healthcare costs that can otherwise be overwhelming, from hospital stays to routine doctor visits. Understanding Medicare begins with knowing its four main parts: Part A, Part B, Part C, and Part D.

Part A covers hospital insurance, including inpatient care, skilled nursing facilities, hospice care, and some home health services. Most people don’t pay a premium for Part A if they or a spouse have worked and paid Medicare taxes.

Part B is medical insurance that helps cover doctor visits, outpatient care, preventive services, and durable medical equipment. Unlike Part A, Part B usually requires a monthly premium, along with deductibles and coinsurance for services.

Part C, or Medicare Advantage, combines the benefits of Part A and Part B into one plan. Many Part C plans also include prescription drug coverage (Part D) and may offer additional benefits like dental, vision, and hearing care.

Part D focuses exclusively on prescription drugs, helping to lower the cost of medications.

Choosing the right Medicare plan depends on your healthcare needs, budget, and preferred doctors. In the following sections, we’ll explore each part in detail, helping you understand exactly what Medicare covers and what it doesn’t so you can make informed decisions about your health coverage.

Medicare Part A Coverage

Medicare Part A, also known as hospital insurance, is often considered the foundation of Medicare. It primarily covers inpatient care, making it essential for anyone who may require hospitalization.

Part A helps pay for hospital stays, including semi-private rooms, meals, nursing services, and other necessary hospital services and supplies. Most people do not pay a monthly premium for Part A if they or their spouse have worked and paid Medicare taxes for at least 10 years.

In addition to hospital care, Part A also covers skilled nursing facility (SNF) care following a hospital stay. This coverage is intended for rehabilitation services such as physical therapy, intravenous therapy, or wound care.

However, it does not cover long-term care or custodial care, which means care focused primarily on daily activities rather than medical treatment.

Hospice care is another important benefit under Part A, offering support for individuals with terminal illnesses. This includes pain management, counseling, and respite care for family members.

Part A also covers certain home health services for patients who are homebound and require intermittent skilled care, such as nursing visits or therapy services.

It’s important to note what Part A does not cover, such as most dental care, routine eye exams, hearing aids, and long-term custodial care. Understanding these limitations can help you plan for additional coverage through Part B, Part C, or supplemental insurance.

Medicare Part B Coverage

Medicare Part B, or medical insurance, complements Part A by covering a wide range of outpatient services and preventive care.

While Part A focuses on hospital stays, Part B helps pay for doctor visits, diagnostic tests, lab work, and outpatient treatments, making it essential for day-to-day medical needs.

Most beneficiaries pay a monthly premium for Part B, and costs can vary depending on income. Additionally, deductibles and coinsurance typically apply for each service.

Preventive services are a major advantage of Part B. This includes screenings for cancer, heart disease, diabetes, vaccines like flu and COVID-19, and wellness visits to help detect health issues early.

These services are often covered at no extra cost to the patient, encouraging proactive healthcare.

Part B also covers durable medical equipment (DME), such as wheelchairs, walkers, oxygen equipment, and certain home health supplies.

Some home health services not fully covered by Part A are also included, like skilled nursing visits and physical therapy, provided the patient meets eligibility requirements.

However, Part B does have limitations. It does not cover most prescription drugs (except certain infused or injected medications administered in a medical setting), long-term care, routine dental care, or cosmetic procedures.

Understanding Part B coverage is crucial for budgeting healthcare expenses and avoiding unexpected costs. By combining Part A and Part B, beneficiaries get comprehensive coverage for both hospital and outpatient services, forming what is often called “Original Medicare.”

Medicare Part C (Medicare Advantage) Coverage

Medicare Part C, commonly known as Medicare Advantage, is an alternative to Original Medicare (Parts A and B).

These plans are offered by private insurance companies approved by Medicare and combine hospital (Part A) and medical (Part B) coverage into a single plan.

Many Medicare Advantage plans also include prescription drug coverage (Part D), simplifying healthcare management under one policy.

One of the main advantages of Part C is that it often offers extra benefits that Original Medicare does not cover.

These can include vision care, dental services, hearing aids, gym memberships, and wellness programs.

Some plans also provide transportation services to medical appointments or coverage for routine preventive care beyond standard Medicare offerings.

While Part C can be convenient and offer more comprehensive benefits, it’s important to understand the costs involved.

Most plans require a monthly premium in addition to the Part B premium, and copays or coinsurance may apply for certain services.

Coverage rules, networks, and costs vary widely depending on the plan and the provider, so beneficiaries should carefully compare options before enrolling.

Medicare Advantage plans may use Health Maintenance Organization (HMO) or Preferred Provider Organization (PPO) structures, which can limit your choice of doctors or require referrals for specialists.

Despite these restrictions, Part C can be an attractive choice for those seeking a more all-in-one approach to healthcare coverage, especially if you want additional benefits not included in Original Medicare.

Medicare Part D Coverage

Medicare Part D provides prescription drug coverage, helping beneficiaries manage the cost of medications. Unlike Parts A and B, which cover hospital and medical services, Part D specifically focuses on outpatient prescription drugs.

These plans are offered by private insurance companies approved by Medicare and can be added to Original Medicare or included in most Medicare Advantage (Part C) plans.

Part D plans have a formulary, which is a list of covered medications. Formularies vary by plan, so it’s important to check whether your medications are included before enrolling.

Medications are often organized into tiers, with lower-tier drugs costing less and higher-tier or specialty medications costing more. Part D also has a deductible and copay or coinsurance structure, which can vary depending on the plan.

One important aspect of Part D is the coverage gap, sometimes called the “donut hole.” In this phase, beneficiaries may temporarily pay more for prescriptions until reaching a certain spending threshold.

After the gap, catastrophic coverage kicks in, reducing costs for expensive medications.

Enrolling in Part D at the right time is crucial. Missing the initial enrollment period may lead to late enrollment penalties, which can increase monthly premiums.

Additionally, comparing different plans each year during the annual enrollment period can help ensure you are getting the best coverage for your medication needs at the lowest possible cost.

Part D ensures that medications, an essential part of many healthcare regimens, are more affordable, making it a vital component of comprehensive Medicare coverage.

What Medicare Does Not Cover

While Medicare provides essential healthcare coverage, it does have limitations. Knowing what’s not covered is just as important as understanding what is, so you can plan accordingly and avoid unexpected expenses.

One major area Medicare generally does not cover is routine dental care. This includes cleanings, fillings, dentures, and other dental procedures. Similarly, Medicare typically excludes routine vision care, such as eye exams, glasses, or contact lenses, unless part of a medical condition covered under Part B.

Hearing aids and hearing exams are also not covered under Original Medicare, although some Medicare Advantage plans may offer limited benefits.

Long-term care is another area excluded from standard Medicare coverage. While Part A covers skilled nursing care for rehabilitation after a hospital stay, ongoing custodial care help with daily activities like bathing, dressing, and eating is not included.

Cosmetic procedures, acupuncture, and alternative therapies are usually not covered either.

Prescription drugs are mostly covered only through Part D or a Medicare Advantage plan with drug coverage, so relying solely on Original Medicare may leave you exposed to medication costs.

Travel-related healthcare outside the United States is also not generally covered, except in very specific situations.

Understanding these exclusions can help you decide whether supplemental coverage, such as Medigap policies or additional private insurance, is necessary.

By identifying gaps in your coverage, you can make informed decisions to protect your health and finances while maximizing the benefits Medicare does provide.

Costs and How Coverage Works

Understanding Medicare costs is essential for planning your healthcare budget. While Medicare provides significant coverage, beneficiaries are responsible for certain premiums, deductibles, and coinsurance.

Part A is often premium-free for most people who have worked and paid Medicare taxes for at least 10 years. However, deductibles apply for each hospital stay, and coinsurance may be required for extended hospital or skilled nursing facility care.

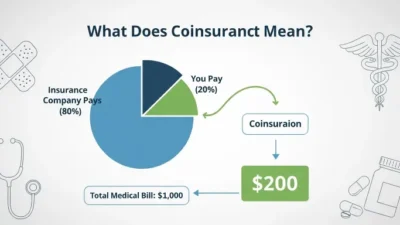

Part B requires a monthly premium, which varies based on income. In addition to the premium, beneficiaries must pay an annual deductible, after which coinsurance typically covers 20% of most outpatient services, including doctor visits, lab tests, and durable medical equipment.

Part C (Medicare Advantage) usually requires the Part B premium plus an additional plan-specific premium.

Copays and coinsurance vary depending on the plan, provider network, and covered services. Many Advantage plans also include prescription drug coverage and may offer extra benefits, but costs and rules differ widely, so comparing plans is crucial.

Part D premiums also vary by plan, with deductibles and tiered copays or coinsurance for medications. Beneficiaries should be aware of the coverage gap, known as the “donut hole,” which may temporarily increase out-of-pocket costs for prescriptions.

Additional options like Medigap (supplemental insurance) can help cover deductibles, coinsurance, and other out-of-pocket expenses, providing peace of mind and predictable healthcare costs.

Understanding how premiums, deductibles, and coinsurance interact across all parts of Medicare ensures that you can plan for both routine care and unexpected medical expenses.

Tips to Maximize Medicare Benefits

Maximizing your Medicare benefits ensures you get the most value from your coverage while minimizing out-of-pocket costs.

The first step is understanding the differences between Original Medicare (Parts A and B) and Medicare Advantage (Part C).

Original Medicare offers broad coverage but may require supplemental insurance, while Advantage plans often include extra benefits like dental, vision, and wellness programs. Choosing the plan that aligns with your healthcare needs is critical.

Reviewing your prescription drug coverage annually is another important strategy. Part D formularies change each year, so checking whether your medications are covered and comparing costs across different plans can prevent unexpected expenses.

Additionally, consider enrolling in Medigap (supplemental insurance) if you want predictable costs for deductibles, coinsurance, and copayments not fully covered by Original Medicare.

Taking full advantage of preventive services under Part B is also key. Vaccines, screenings, and annual wellness visits are often covered at no cost and help detect health issues early, reducing long-term medical costs.

Scheduling routine checkups, managing chronic conditions, and following your doctor’s recommendations can prevent costly hospitalizations or procedures.

Finally, keep track of your enrollment periods to avoid late penalties. For most people, the Initial Enrollment Period begins three months before turning 65.

The Annual Enrollment Period (October 15–December 7) allows switching plans or adjusting coverage for the following year.

By staying informed and proactive, you can maximize your Medicare benefits and ensure comprehensive, cost-effective healthcare coverage.

Frequently Asked Questions

Medicare can be complex, and many beneficiaries have similar questions about what it covers and how it works. Here are some of the most commonly asked questions:

1. Does Medicare cover dental care?

Original Medicare (Parts A and B) generally does not cover routine dental services, such as cleanings, fillings, or dentures. Some Medicare Advantage (Part C) plans may offer limited dental coverage.

2. Does Medicare cover vision or hearing aids?

Routine eye exams, glasses, and hearing aids are not typically covered under Original Medicare. Certain Medicare Advantage plans may include partial coverage for these services.

3. Can I switch Medicare plans anytime?

You can generally enroll in or switch plans during the Annual Enrollment Period (October 15–December 7) each year. There are also Special Enrollment Periods for qualifying life events, such as moving or losing other coverage.

4. Does Medicare cover prescription drugs?

Prescription drugs are covered under Part D or included in most Medicare Advantage plans. It’s important to check the formulary of each plan to ensure your medications are covered.

5. Are preventive services covered?

Yes. Medicare Part B covers many preventive services, including vaccines, screenings for cancer or heart disease, and annual wellness visits, often at no additional cost to you.

6. What isn’t covered by Medicare?

Services like long-term custodial care, cosmetic procedures, and alternative therapies are generally not covered. Supplemental insurance or Medicare Advantage plans may help fill these gaps.

By understanding these FAQs, you can make better-informed decisions about your healthcare and choose coverage that meets your needs while avoiding unexpected costs.

Conclusion:

Understanding what Medicare covers is essential for anyone approaching 65 or planning for healthcare needs in the future.

Medicare provides comprehensive coverage through its four main parts Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage) each designed to address specific aspects of healthcare.

By knowing what is included, such as hospital stays, doctor visits, preventive services, and medications, as well as what is excluded, like routine dental, vision, hearing aids, and long-term custodial care, you can make informed decisions about your health coverage.

Choosing the right plan depends on your individual needs, budget, and preferred providers.

Original Medicare offers flexibility but may require supplemental coverage, while Medicare Advantage plans often include additional benefits and simplify coverage under one plan.

Paying attention to costs, including premiums, deductibles, coinsurance, and copayments, is also crucial for avoiding unexpected expenses.

Maximizing your Medicare benefits involves staying proactive: reviewing prescription drug plans annually, taking advantage of preventive services, and considering supplemental insurance options if needed.

Staying informed about enrollment periods and plan changes ensures you maintain continuous coverage and avoid penalties.

By fully understanding Medicare, you can confidently navigate your healthcare options, protect your financial wellbeing, and ensure access to the care you need.

If you are enrolling for the first time or reviewing your current plan, having a clear roadmap helps you make the most of your Medicare benefits and achieve peace of mind.

I am Harper Lee, the voice behind Jokestide.com, where humor meets creativity.

I am here to serve fresh, trending jokes and puns that make every scroll worth it.

I am turning everyday smiles into share-worthy laughs welcome to the fun side of the web